illinois employer payroll tax calculator

Web In 2022 the Illinois state unemployment insurance SUI tax rate will range from 0725 to 71 with a maximum taxable wage base of 12960. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois.

Free Llc Tax Calculator How To File Llc Taxes Embroker

Web The maximum an employee will pay in 2022 is 911400.

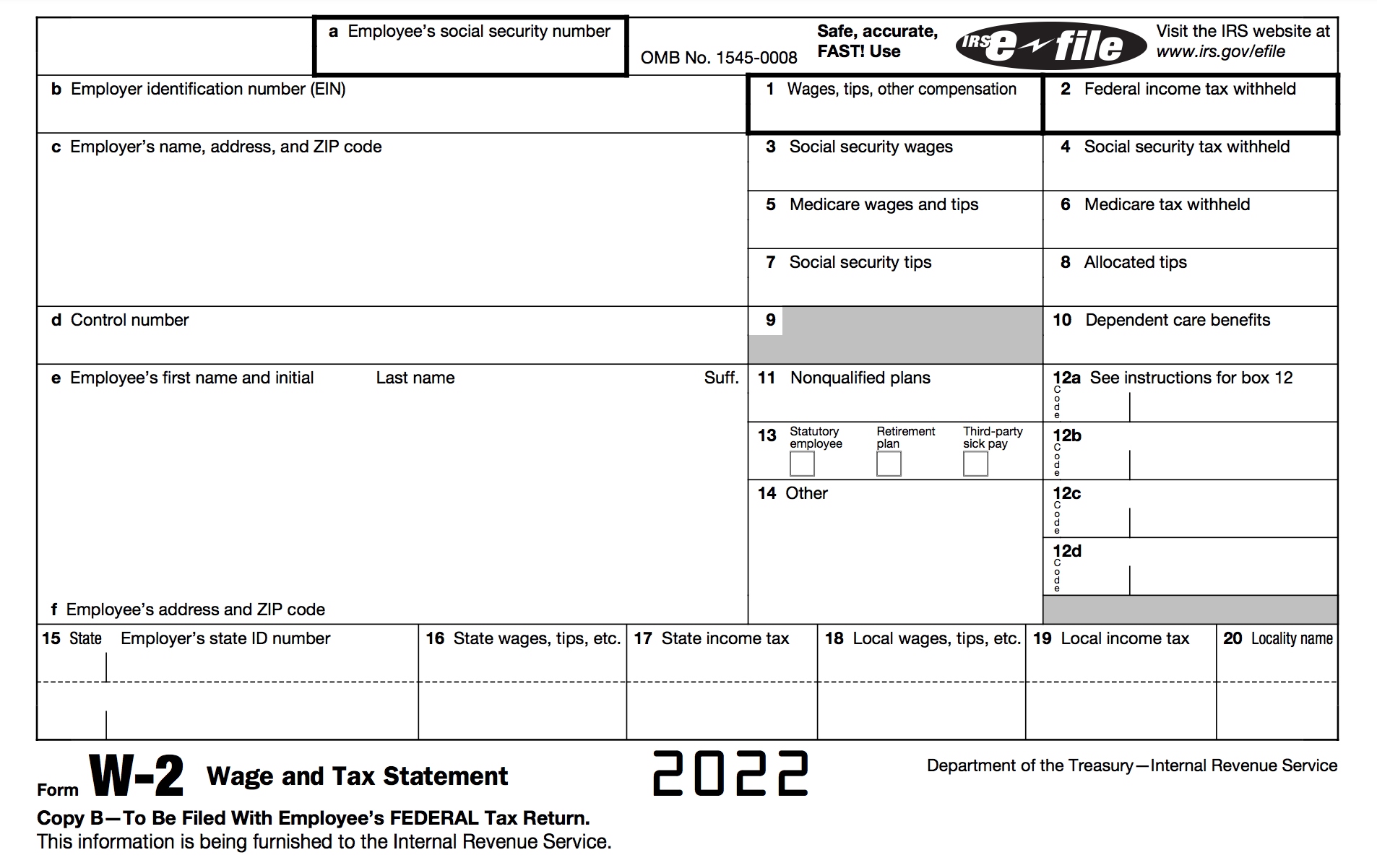

. Simply enter their federal and state W-4. Web For more IDES employer contact information or call. Web Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Figure out your filing status. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Select a State Annual Wage.

Web Publication 130 Who is Required to Withhold Illinois Income Tax Publication 131 Withholding Income Tax Payment and Filing Requirements FS-13 Minimum Wage Credit. The Employer Services Hotline at 800-247-4984 The Tax Hotline TTY number is 866-212-8831. Just enter the wages tax withholdings and other information.

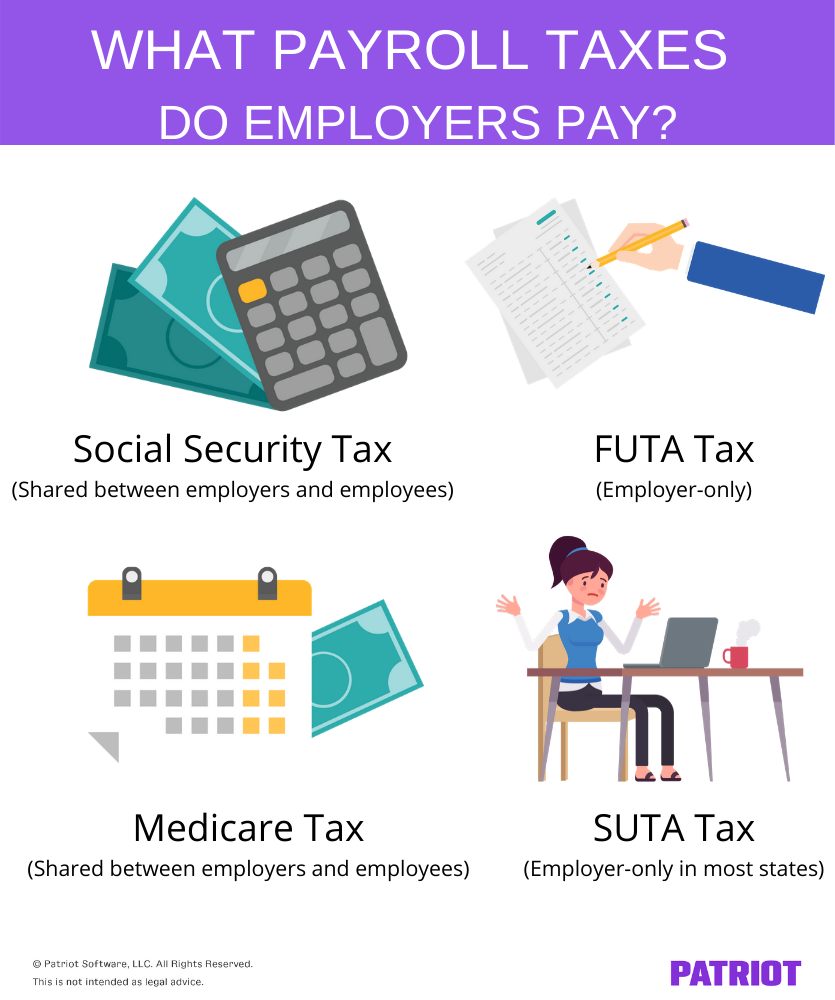

Web Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. Web payroll withholding calculator 2010 postalda from postaldamyblogit Calculates federal fica medicare and withholding taxes for all 50 states. Web It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

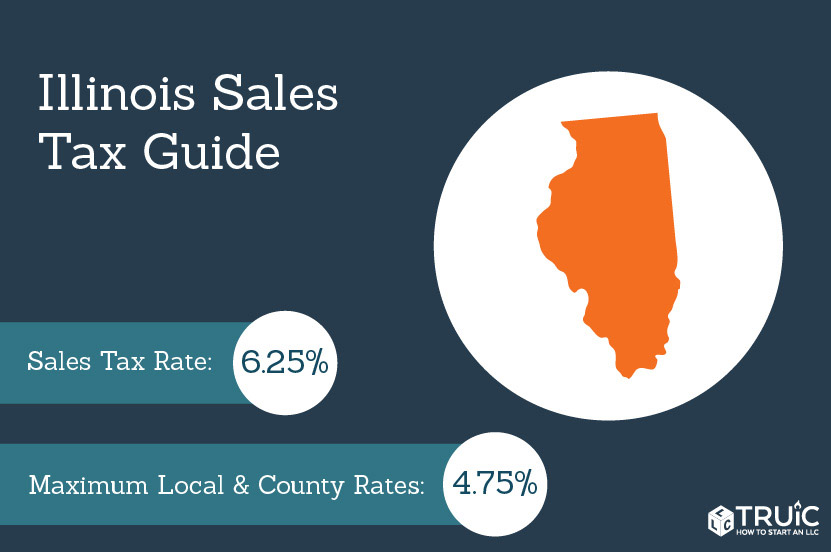

For experience-rated employers those with three or more years of experience the. Withhold 62 of each employees taxable wages until they. Web The state income tax rate in Illinois is under 5 while federal income tax rates range from 10 to 37 depending on your income.

Web The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or. Your household income location filing status and number of. This income tax calculator can help estimate.

Showing 1 to 6 of 6 entries. Back to top If I want to. Click here for an historical rate chart.

In 2022 the illinois state unemployment insurance sui tax rate will range from 0725 to 71 with a. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web What is Payroll Tax.

Work out your adjusted. Web Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this. Illinois Tax Information Withholding Requirements Register as an employer on the Illinois.

Web Use the Illinois paycheck calculators to see the taxes on your paycheck. Web Report to Determine Liability for Domestic Employment - If you or your organization paid a domestic worker or combination of domestic workers cash wages totaling at least 1000. This years guidelines saw a.

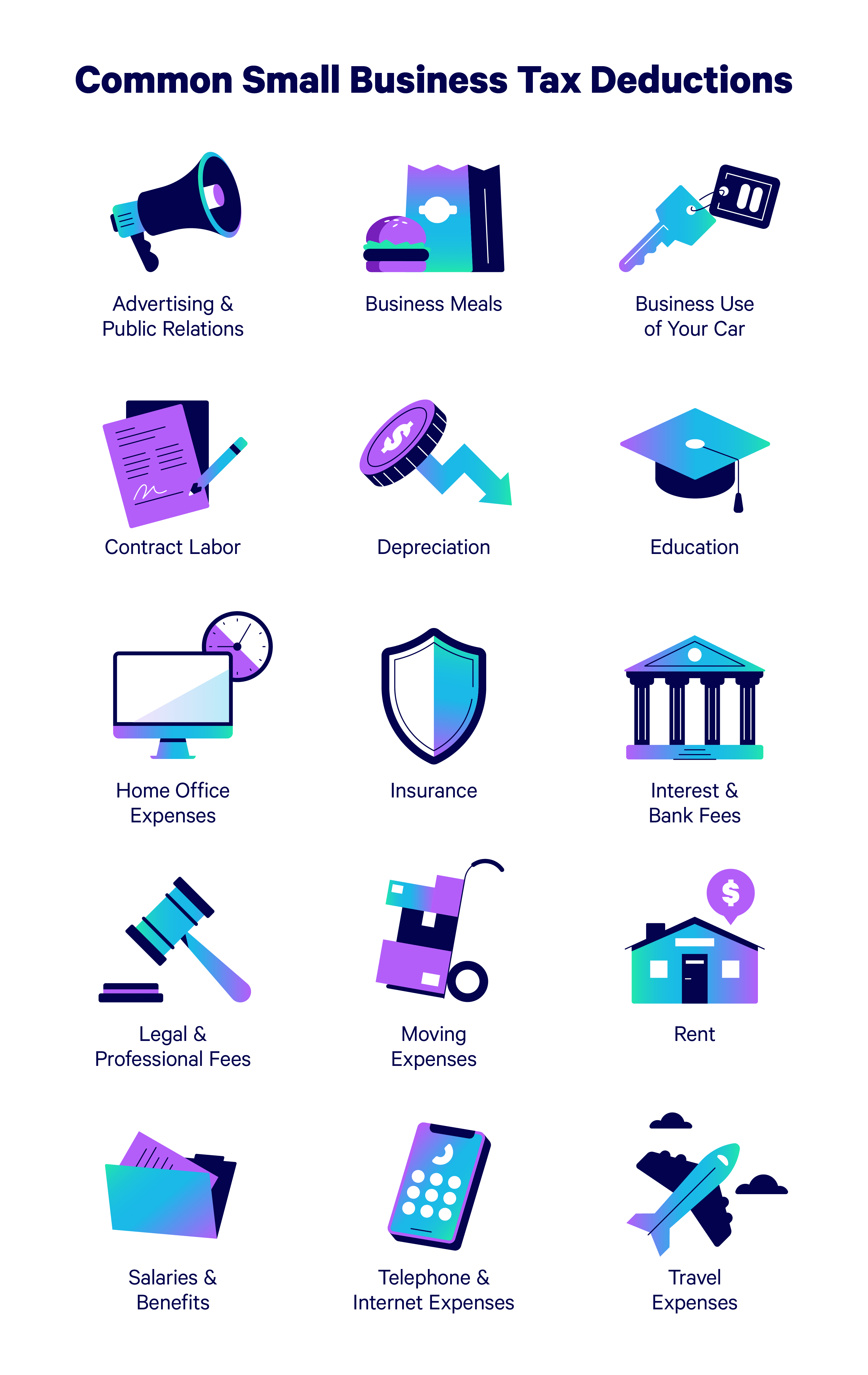

From the salary that an employee of a company is entitled to the employer deducts a certain specified sum and pays it to the state and federal. Web Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee.

1099 Tax Calculator How Much Will I Owe

How To Fill Out A W 2 Tax Form For Employees Smartasset

Free Llc Tax Calculator How To File Llc Taxes Embroker

Illinois Paycheck Calculator Smartasset

Payroll Tax Calculator For Employers Gusto

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

Payroll Tax Credit Offset Striketax Com

Payroll Taxes Paid By Employer Overview Of Employer Liabilities

Employer Payroll Tax Calculator Free Online Tool By Incfile

Understanding Payroll Taxes And Who Pays Them Smartasset

What Are Employer Taxes And Employee Taxes Gusto

Alabama Hourly Paycheck Calculator Gusto

Tax Withholding For Pensions And Social Security Sensible Money

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal Payroll Tax Rates Abacus Payroll

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022